What is VAT?

VAT is an indirect tax that is levied on the consumption of products or services provided by professionals. Although businessmen are obliged to declare and pay this tax periodically to the Treasury, its direct payment corresponds to the final consumers.

What is VAT called in Spain?

It is generally known as consumption tax or VAT (acronym for Value Added Tax). All citizens must pay this tax on their purchases, regardless of their purchasing power.

What is the VAT rate in Spain?

Super-reduced rate (4%)

Applies to essential goods (eg: basic food).

Reduced rate (10%)

Rest of food and certain cultural events.

General rate (21%)

It is the one that taxes the remaining products and services.

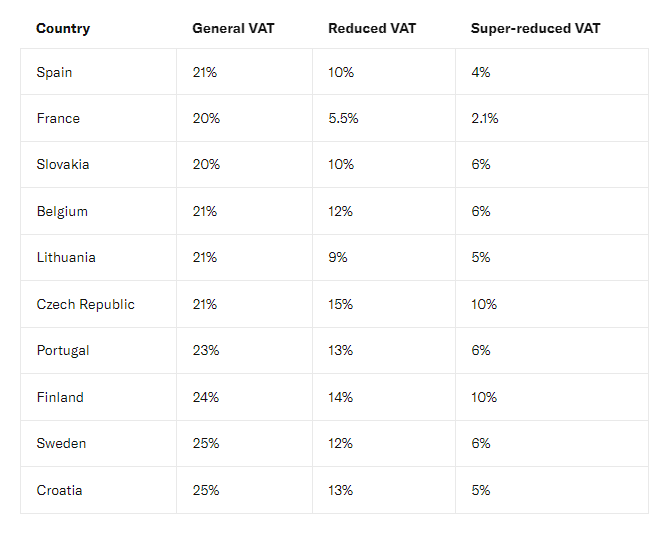

VAT number in Spain and Europe

What if I have a foreign company in Spain?

Any company that operates in our country selling products and services is required to collect this tax and pay it to the Treasury. All you need to do this is a VAT registration number in Spain: the CIF.

Thus, whatever the nationality of your company, it is highly recommended to obtain a VAT registration in Spain. as soon as possible. Thanks to it, you will not only be able to faithfully comply with the law, but you will also be able to obtain various benefits for your business (import products, make distance sales, reverse the tax, etc.).

How can my company pay Spain VAT?

The bureaucratic procedures in Spain are not simple and it is very convenient to obtain advice from experienced professionals in Spanish law. A wrong step when obtaining the spanish vat number could lead to many legal problems.

If you live in marbella or Fuengirola and you need a VAT lawyers, contact with us.

The best option to carry out these complicated procedures on the right way is to get the hands of a multilingual team of lawyers, such as GM Lawyers: the law firm in Marbella that speaks to you in your own language. Our professional advice is all you need to pay VAT in Spain in a comfortable and simple way.